Finding your dream house in a neighborhood you’ve always wanted to live in has to be a dream come true. What is even better is when the house is within your budget.

However, it might be heartbreaking to discover that the house has foundation issues during the inspection stage.

It can be daunting to decide whether to go ahead with the purchase, especially if the house ticks all the other boxes. However, deciding whether to buy a property with foundation issues is not black and white.

Some problems are speedbumps on your homeownership journey, while some severe issues can be automatic dealbreakers.

It is vital not to ignore any foundation issues when buying a house. While some issues are minor and can easily be fixed, there are severe issues that can compromise the structural integrity of the building.

Here are considerations when deciding on whether to buy a house with foundation issues:

- Your budget – Foundation evaluation and repairs are expensive.

- The extent of damage on the foundation.

- Your time restriction.

This article discusses foundation issues, their causes, and how you can identify them. We’ll also let you know the steps you should take when discovering foundation issues in a home you’re considering buying.

What Causes Foundation Issues

A house’s foundation is typically constructed as the first thing when building a structure. It is what supports the entire building while keeping out groundwater.

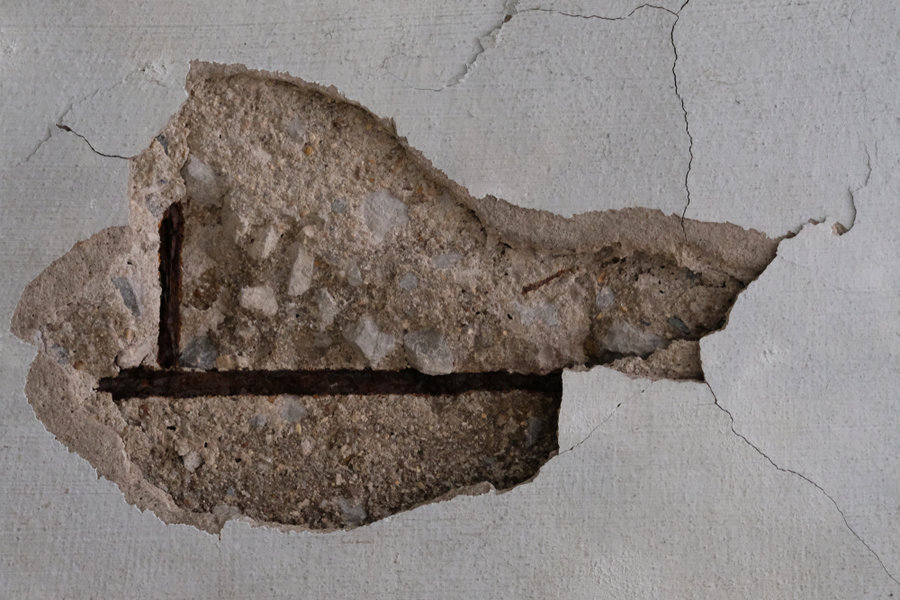

Foundation issues, therefore, refer to any problems or damage to the bedrock of a building.

Let’s look at the common causes of foundation issues.

1. Mistakes During Construction

One of the most common causes of foundation issues is faulty construction. Faulty construction can include poor soil compaction around the foundation, poor concrete mixture and curing, or building a foundation on fill dirt.

Eventually, buildings with faulty foundation construction develop foundation problems.

2. Drainage and Plumbing Problems

It is vital to ensure proper drainage around your house because water collecting in pools will seep into the soil, causing it to expand and contract when it dries out. The constant expansion and contraction of soil below your foundation can cause damage to the foundation.

Therefore, it is vital to ensure that gutters drain water away from the house and that you fix any leaking pipes promptly.

3. Poor Soil Conditions

Some soil types, such as clay, have high absorbency rates. Building a foundation on such soils can lead to stress on the foundation. This is due to the expansion and contraction of the soil as a result of fluctuating moisture levels.

This can eventually cause issues with the foundation.

How To Identify Foundation Issues

Here’s how you can identify foundation issues based on whether they are major or minor:

1. Minor Foundation Issues

Minor foundation issues might not cause alarm when buying a house. Ideally, these minor issues are caused by normal foundation settling and can usually be repaired easily and prevented from worsening.

They include:

- Cracks on a stone veneer.

- Cracks in the mortar between blocks.

- Signs of moisture.

2. Major Foundation Issues

Below are indicators that the foundation might have significant issues.

- Uneven floors.

- Window or door frames separate from the surrounding bricks.

- Large horizontal or zig-zag cracks on the exterior or interior walls.

- The structure looks uneven from a distance.

- The doors seem uneven, and they don’t latch.

- Extended cracks on floor tiles.

- Walls bowing or pulling away.

- A large gap between the walls of the building and the soil.

What To Do When You Discover Foundation Issues

It is not unusual to come across buildings with foundation issues when looking for a house. However, it is not advisable to ignore any foundation issue as it could be catastrophic later.

Here are some tips you should consider if you identify a house that you like but has foundation issues:

1. Inform Your Real Estate Agency

Immediately you notice foundation issues on the house, your first call should be your real estate agent. They can advise on how to proceed by recommending other houses or a reputable contractor for repairs.

2. Bring a Structural Engineer on Board

It is best to hire a structural engineer so they can expound on the severity of the problem. A professional can also unveil other issues that may not be obvious to you.

They can establish whether there are any repairs that the seller had done to the foundation before listing it. In case there are repairs that the seller has done, it’s vital to establish which company has done them.

Also, find out if the repairs had a warranty and whether it’s transferrable, as this can save you the cost of the pending and future repairs.

3. Negotiate a Discount or Decide To Walk Away

With feedback from a structural engineer, you can make an informed decision on whether to proceed with the purchase. If you decide to proceed, negotiate with the seller on whether they can make the repairs for you.

Alternatively, agree on a reduced price so that you’re the one who will cover the repairs.

On the other hand, you can decide that you don’t want to spend the time, money, and energy involved in repairing a house’s foundation. Instead, you can look for another property, and you might even land a much dreamier house.

Unfortunately, depending on when your mortgage approval expires, you may have to start the mortgage approval process all over again.

4. Discuss With Your Lender or Pay Cash

You’ll need to talk to your lender if they have already approved your mortgage and its issuance depends on the house meeting the lender’s requirements.

You can persuade the loan officer to issue the loan as long you can increase your downpayment to cover the risks the lender would have to absorb and the repairs.

You can also pay for the property in cash on the newly agreed terms if you assess that you can make profits after you repair the house’s foundation and resell it.

When Not To Buy a House With Foundation Issues

Unfortunately, in some cases, you may have to walk away from a house due to foundation issues.

Some situations might be:

- The house requires expensive repairs that neither you nor the seller can pay for.

- Suppose you have a time constriction- if you want to move in or sell immediately. For example, repairing a foundation takes time.

- If you’re looking for a turn-key home.

- If a structural engineer advises that the building is beyond repair.

Conclusion

Not all foundation issues are a sign that the house will collapse. However, in some instances, if the house has repairable foundation issues, you might get a better deal on the cost.

However, buying a home with foundation issues might affect your loan approval, the move in time-frame, and the resale value.

If you discover foundation issues, it is best to hire a structural engineer to conduct an in-depth analysis of the severity of the problems. They can then advise on possible repairs or the dangers involved in proceeding with the purchase.

You can also choose to continue house-hunting because, eventually, you might be glad you dodged a bullet.

Frequently Asked Questions

What Should I Do if I Discover Foundation Issues After Closing a Deal?

You should immediately contact a real estate lawyer. A seller can be considered to be in breach of contract if they withhold essential information about the condition of the building.

A real estate lawyer can represent you and help you get the issues fixed by the seller or get a refund from the seller for the repairs.

How Can You Tell That a House Has Foundation Issues?

Some common indicators of foundation issues in a building include:

- Window or door frames separate from the surrounding bricks.

- Large horizontal or zig-zag cracks on the exterior or interior walls.

- The doors seem uneven, and they don’t latch.

- Extended cracks on floor tiles.

- Walls bowing or pulling away.

Can I Get Funding for a House With Foundation Issues?

Most lenders are adamant about funding the purchase of houses with severe foundation issues. However, you can get a mortgage if the defects are minor.

You can also access a renovation mortgage from select lenders, but such loans come at higher interest rates than regular mortgages.